Mastering Your Financial Future: The Power of Systematic Investment Plans (SIPs)

- valuesnwealth

- Oct 10, 2024

- 4 min read

Did you know that investing as little as ₹500 a month could potentially transform your financial future? It's true, and it's all thanks to a nifty little tool called a Systematic Investment Plan, or SIP for short. Let's dive into this game-changer and see how it might just be the secret sauce your portfolio's been missing.

What is a Systematic Investment Plan (SIP)?

Imagine you're at an all-you-can-eat buffet, but instead of piling your plate high in one go, you make multiple trips, sampling a bit of everything. That's essentially what a SIP does for your investments. It's a way to nibble at mutual funds regularly, rather than gorging on a lump sum all at once.

Here's the deal: you pick a mutual fund, decide how much you want to invest (remember, it can be as low as ₹500), and how often. Then, you set it and forget it. Well, not entirely, but you get the idea. Your bank account automatically sends that money to your chosen fund on schedule. Easy peasy, right?

The Mechanics Behind SIPs

Rupee Cost Averaging

Now, here's where it gets interesting. SIPs use this cool trick called rupee cost averaging. It's like being a savvy shopper who buys more when prices are low and less when they're high. When the market's down, your fixed investment buys more units of the fund. When it's up, you get fewer. Over time, this can smooth out those nasty market bumps and potentially lower your average cost per unit.

Power of Compounding

Ever heard the phrase "money makes money"? That's compounding in a nutshell, and SIPs are all about it. Your returns get reinvested, potentially earning even more returns. It's like a snowball rolling down a hill, getting bigger and bigger. And the earlier you start, the more time that snowball has to grow. According to the Association of Mutual Funds in India, the difference in returns between early and late starters can be staggering.

Key Benefits of Systematic Investment Plans

Disciplined Investing

Let's face it, we humans aren't always great at sticking to plans. SIPs are like a financial gym buddy, keeping you on track with your investment routine. They take the emotion out of investing, so you're not tempted to bail when the market gets a bit wobbly.

Flexibility and Convenience

Life's unpredictable, right? SIPs get that. Need to take a break or bump up your investment? No problem. You can adjust, pause, or restart your SIP as needed. It's like having a choose-your-own-adventure book for your finances.

Professional Fund Management

Unless you're a financial whiz with oodles of free time, managing investments can be a headache. SIPs in mutual funds come with a built-in money manager. These pros eat, sleep, and breathe investments, so you don't have to.

Considerations When Starting a SIP

Investment Goals and Time Horizon

Before you jump in, ask yourself: What am I saving for? A swanky retirement? A dream home? Your timeline and goals will shape your SIP strategy. It's like planning a road trip – you need to know where you're going and how long you've got to get there.

Risk Appetite and Fund Selection

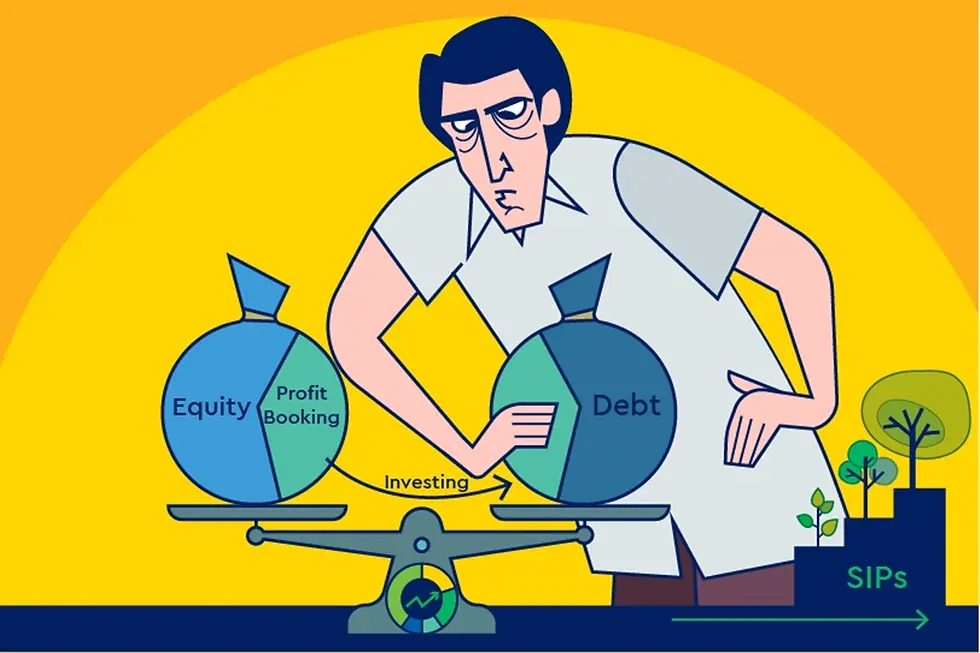

Are you a roller coaster enthusiast or more of a merry-go-round person? Your risk tolerance will guide your fund choices. There's a whole buffet of options out there, from play-it-safe debt funds to go-big-or-go-home equity funds. ETMoney suggests that your investment goals, time horizon, and risk appetite are key factors in making these choices.

Costs and Fees

Nothing in life is free, and SIPs are no exception. Keep an eye out for entry loads, exit loads, and those pesky expense ratios. They might seem small, but over time, they can take a bite out of your returns.

SIPs vs. Lump Sum Investments

So, you've got a chunk of cash burning a hole in your pocket. Should you dump it all in at once or go the SIP route? Well, it depends. Lump sum investments can be great if you've got a crystal ball and can time the market perfectly. But for us mere mortals, SIPs offer a more steady, less ulcer-inducing approach.

Regulatory Aspects and Investor Protection

Now, let's get serious for a moment. SIPs aren't the Wild West of investing. They're regulated as Periodic Investment Plans under securities laws. That's good news for you, as it means there are rules in place to keep things fair and transparent. But, and it's a big but, you've got to do your homework. According to the Cornell Law School, some SIPs come with hefty upfront costs or sales fees, especially if you bail early. So read the fine print, folks!

Getting Started with SIPs

Ready to dip your toes in? Here's your game plan:

Find a reputable mutual fund company or investment platform.

Pick a fund that matches your goals and risk tolerance.

Decide how much and how often you want to invest.

Fill out the paperwork and set up those automatic bank transfers.

Keep an eye on things and adjust as needed.

Just remember, investing isn't a set-it-and-forget-it deal. Don't fall into the trap of investing without clear goals, putting all your eggs in one basket, or constantly switching strategies because the market's having a mood swing.

So there you have it, folks. Systematic Investment Plans: your ticket to potentially mastering your financial future. They're not a magic wand, but they might just be the next best thing. With their mix of discipline, flexibility, and the power of compounding, SIPs could be your secret weapon in the battle for financial freedom. So why not give them a shot? Your future self might just thank you for it.

Comments